The death claim forms listed on this page can only be used with the following annuity contracts:

- All Western United Life Insurance Company annuity contracts, and

- Manhattan Life Insurance Company annuity contract numbers beginning with “ML” only.

PLEASE NOTE:

Please check your annuity contract number before choosing a death claim form from this page.

Annuity Death Claim Forms

Beneficiary request to elect a payment option upon the inheritance of an annuity contract. Also print State Tax Withholding Instructions to determine if state taxes are required to be withheld.

Annuity Claimant’s Statement for Established Periodic Payments

Beneficiary request to continue established periodic payments. Also print State Tax Withholding Instructions to determine if state taxes are required to be withheld.

Beneficiary Annuity Contract Change Request

To be used only by Spouse Beneficiary to endorse a contract. Also print Beneficiary Substitute IRS W-4P and W9 form.

To be used by Spouse Beneficiary to endorse a contract, or other Beneficiary to change existing withholding instructions. Also print State Tax Withholding Instructions to determine if state taxes are required to be withheld.

State Tax Withholding Instructions

Guide for determining state tax withholding.

Trust Information; Trustee Certification Indemnification Agreement

To be completed when a trust applies for an annuity, changes trustees/ownership, or makes a claim for a death benefit as a beneficiary.

Complete, sign and return as applicable. Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)

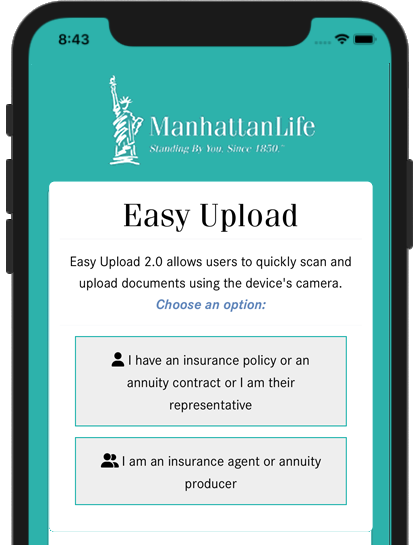

EASY UPLOAD MOBILE APP

The Easy Upload mobile app or the Form Upload tool found on the Client Services site can be used to securely send documents to us regarding a specific Life & Health policy or Annuity contract, even if you aren’t a registered contract/policy holder. Simply click on the Start Uploading button. You will need to know the contract/policy number and the owner’s zip code to use this feature.