ManhattanLife Annuities: Multi-Year Guarantee Annuities (MYGAs)

Multi-Year Guarantee Annuity (MYGA) Overview

What is a MYGA?

First, let's start with a fixed annuity. A fixed annuity is a contract between you and an insurance company that helps provide you with saving and income options for retirement.

A MYGA, or multi-year guarantee annuity, is a specific type of annuity designed to help you accumulate savings. With a MYGA, you deposit a single premium amount, and the insurance company guarantees to pay you specific rate of interest for the period you choose (3, 5, 6, or 7 years).

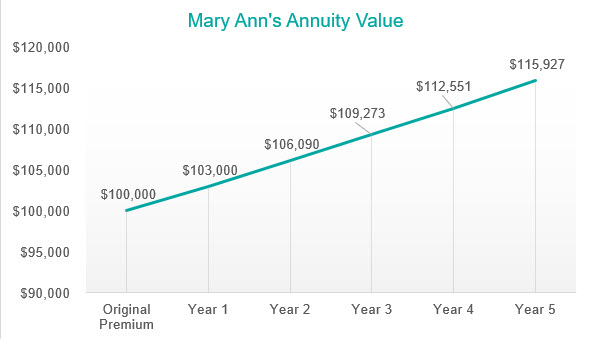

For instance, Mary Ann purchases a 5-year MYGA with $100,000 (her premium) at a rate of 3.00%. Her tax-deferred growth starts immediately! Her single premium earns interest from the contract date, and the interest rate will be credited and compounded daily for an effective annual yield. In 5 years, Mary Ann's money can grow to $115,927! She gets the benefits of a guaranteed low risk investment, compound interest, and tax-deferred growth all in one.

*The above graph assumes no surrenders or other withdrawals are made throughout the contract lifetime.

Isn't that like a Certificate of Deposit (CD)?

In a lot of ways, MYGAs are like CD's you could buy from a financial institution. They both offer a fixed interest rate for a specified period. However, MYGAs offer certain benefits when compared to CD's.

First, MYGAs generally offer higher interest rates than CD's. The average rate on CD's in January 2019 was just 1.25%. By contrast, the average 5-year MYGA rate was 2.87%, with the highest MYGAs crediting upwards of 4.00%!

In addition, all the interest you earn in a MYGA is tax-deferred. That means you only pay interest when you take withdrawals. So instead of being reduced by taxes, more of your money works to earn interest.

That sounds great! What are the downsides?

MYGAs are designed to offer you a safe and consistent return on your money. Because of that safety, they may not be able to offer you the higher returns that other, riskier financial products can offer. MYGAs are best suited for people who want to avoid high risk investments or can't afford to lose portions of their savings if the market drops.

To offer safe returns at a competitive rate, insurance companies generally deduct a fee from surrenders greater than an allowed "free withdrawal" amount taken during the surrender charge period. This fee, called a surrender charge, is often a fixed percentage (such as 8%) of the annuity value (the premium plus interest in the annuity) and generally decreases every year. At the end of the surrender charge period (ranging from 3 to 7 years), you may withdraw your money, start income payments, or start a new guaranteed rate period without a surrender charge.

Do I always have to pay a fee?

We understand that life happens, and you may need your money sooner than you initially thought. With you and the unexpected in mind, many of our MYGAs include generous free withdrawal provisions which allow you to take a portion of your annuity (usually up to 15% of the annuity value) free of charge.

What about income?

MYGAs can also be used to provide income payments. ManhattanLife annuity products offer flexible income options, including life income payments, which can help you worry less about outliving your savings.

How do I know how much I'll get exactly?

Several factors go into calculating the amount that will be paid out, such as the payout option selected, the interest rate, the annuitant's life expectancy, withdrawals taken throughout the annuity's accumulation phase, and more.

Several of ManhattanLife's MYGAs have an MVA. What is that?

An MVA, or market-value adjustment, is a feature that allows us to credit a higher interest rate because you take on some additional risk if you fully surrender your contract or take a withdrawal greater than the allowed amount.

How do I learn more about Annuities from ManhattanLife?

You can have a producer contact you to discuss your goals and annuity options. We offer a variety of annuity products built with our contract holders in mind. You can see an overview of our annuity options here.

Annuity Terms

Accumulation Phase

The period when your annuity earns interest and before payouts begin

Annuity Value

Single premium minus withdrawals and premium taxes (if applicable) plus credited interest

Payout Phase

The period when the insurance company begins making payments according to the terms of your contract

Market Value Adjustment (MVA)

An adjustment that may increase or decrease the amount you receive on withdrawals that are subject to a surrender charge.

Surrender Charge

The exact percentage will be stated in your contract, usually a fixed percentage of the annuity value

Surrender Value

Surrender value = annuity value times MVA, if applicable, minus surrender charges

*Your annuity may be issued by The Manhattan Life Insurance Company or by Western United Life Assurance Company, which are ManhattanLife companies. An annuity is NOT: 1) a certificates of deposit (CD); 2) FDIC or NCUA insured; 3) insured by any federal government agency; or 4) guaranteed by a bank, savings association, or credit union. Guarantees are based on the financial strength and claims-paying ability of ManhattanLife.